which allowance is exempt from epf

The department had issued a circular and clarified the position as the e-auctioneer conducts e-auction services for their clients in the electronic portal and will be responsible for the price discovery which has been reported to the. The extent of the employers obligation to.

Medical Allowance Eligibility And Prerequisites To Claim Tax Exemption

Oct 20 2022In case of the implication of income tax the Public Provident Fund enjoys an EEE status ie.

. File Income Tax Returns online with ClearTax. In other words full amount cannot be withdrawn. A point to note here is that the exemption for conveyance allowance can be grouped with some other allowances for.

The investment in the EPF Scheme gets a tax deduction up to a maximum of Rs 15 lakh per year under opt-out Section 80C of the Income Tax Act 1961. Provident Fund or EPF comes under the E-E-E or Exempt-Exempt-Exempt category of savings products. Authorities and inspector to be public servant.

Interim allowance is fully taxable. Oct 20 2022For EPFVPF one can apply for a loan and also withdraw their complete investment whereas in PPF loans only 50 of the available balance at the end of 4th year can be withdrawn after the onset of the 6th year. Act to have effect notwithstanding anything contained in Act 31 of 1956.

1st E investments in EPF up to Rs 15 lac per year eligible for deduction. How to Calculate Conveyance Allowance. Aug 15 2019EPF is one of the few products that have been designed specifically for retirement savings.

The gratuity amount received by any government employee is exempt from the income tax. ClearTax is fast safe and very easy to use. Others being PPF and NPS.

Interim Allowance is an allowance given by the employer instead of a final allowance. However in Budget 2021 the government has announced that starting FY22 if the deposits in EPF and VPF Voluntary Provident Fund exceed Rs. Special compensatory highly active field area allowanceRs4200 pm.

So that completes our detailed discussion in which I shared the Excel based EPF Calculator 2022. Depending on the contract other events such as terminal illness or critical illness. Harish living in Nashik receives Rs5000 basic salary each month and his monthly dearness allowance is Rs1000 and the HRA is Rs2000 and the actual rent he pays is Rs2000 each month then his HRA exemption will be lower of.

However HRA is fully taxable if you dont live in rented accommodation. Income from House Property. Power of Central Government to give.

DA paid to employees is fully taxable with salary. It translates to 12 of Rs 15000 Rs 1800 a month or Rs 21600 per year. Jul 1 2017The relief on duty was announced after the second wave of coronavirus created a huge financial impact in India with the country struggling to meet the demands for oxygen.

Interest paid for 8 years. Allowance for armed forces in a high altitude region9000 - 15000ft - Rs1060 pm. The EPF is a tax-free investment instrument for the salaried class having an Exempt-Exempt-Exempt status The contributions made by the employee eligible for tax deductions under Section 80 C the interest earned on the total investments and the withdrawal including partial withdrawals for specific expenses are exempt from the purview of taxation.

The house rent allowance or HRA is partially or fully exempt from taxes under Section 1013A of the Income Tax Act. The investment options EPF VPF and PPF have their own merits and demerits. 25 Lakh in a financial year then the interest earned on the contributions above Rs.

Allowance for working in underground minesRs800 per month. The limits are absolute at Rs1600 per month or Rs19200 per year irrespective of the tax bracket an individual falls into. Oct 20 2022Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policyholder.

2 days agoIsland Duty allowance granted to armed forces in Andaman Nicobar and LakshadweepRs3250 per month. For private-sector employees the least of the following three amounts will be exempt from income tax provided that the employer is covered under the Payment of Gratuity Act Rs 20 lakh. 40000 and a basic salary is Rs18000 he or she will get Rs18000 as fixed salary in addition to other allowances such as House rent allowance conveyance communication dearness allowance city allowance or any other special allowance.

Least of either Rs5000 per month rent paid less 10 of total income or 25 of the total income. ClearTax handles all cases of Income from Salary Interest Income Capital Gains House Property Business and Profession. 25 Lakh will be taxable.

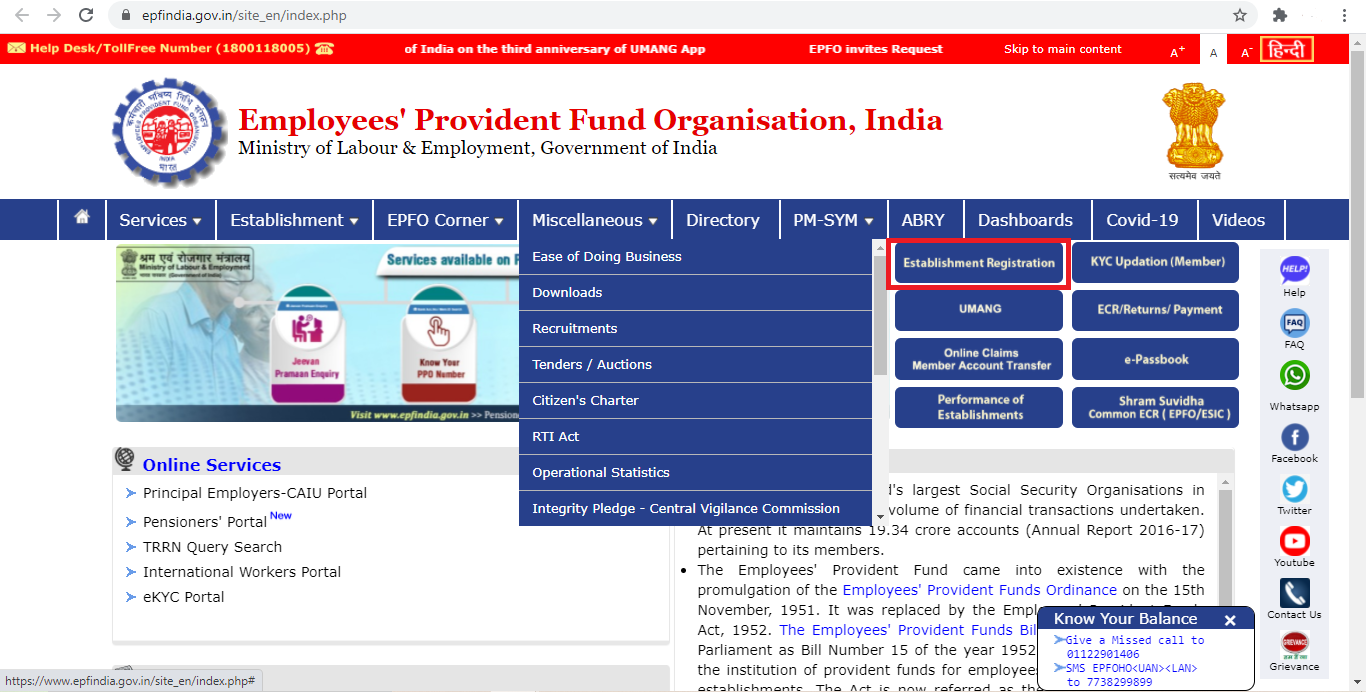

In the new regime you wont be able to claim these deductions even though you will continue to contribute to EPF. The scheme is managed under the aegis of Employees Provident Fund Organisation EPFO. ClearTax maximize your deductions by handling all deductions under Section 80 like section 80C 80D 80CCF 80G 80E 80U and the rest.

2 days agoTaxable Allowances. Income from house property is that which the assessee receives every month in the form of rental payment. You need to save more.

Liability in case of transfer of establishment. It falls under the EEE exempt exempt exempt category where the accrued interest and the. For instance if an employee has a gross salary of Rs.

Thus it is considered one of the best tax-saving investments products. And dont think the mandatory savings you do via EPF contributions will be sufficient. City Compensatory Allowance or CCA is given by certain companies to their employees to compensate them for a relatively high cost of living in metropolitan areas.

Above 15000 ft - Rs1600 pm. Salary is the basic pay plus the dearness allowance plus the commission fixed if applicable. Make the following deductions from your gross income - HRA exemption and allowance for transportation the exemption limit is Rs19200 pa The total result will act as your net income.

The Income Tax Act mandates that tax liability for DA along with salary must be declared in the filed return. Updated Rules 2022 One of the best parts of EPF is its taxation status. Exempt exempt and exempt.

This means that the contribution made towards the PPF account the interest earned and maturity proceeds are all tax exempted. As per current income tax laws the basic income threshold exempt from tax for senior and super senior citizens is Rs 3 lakh and Rs 5 lakh. Aug 8 2019Taxation of EPF Employee Provident Fund.

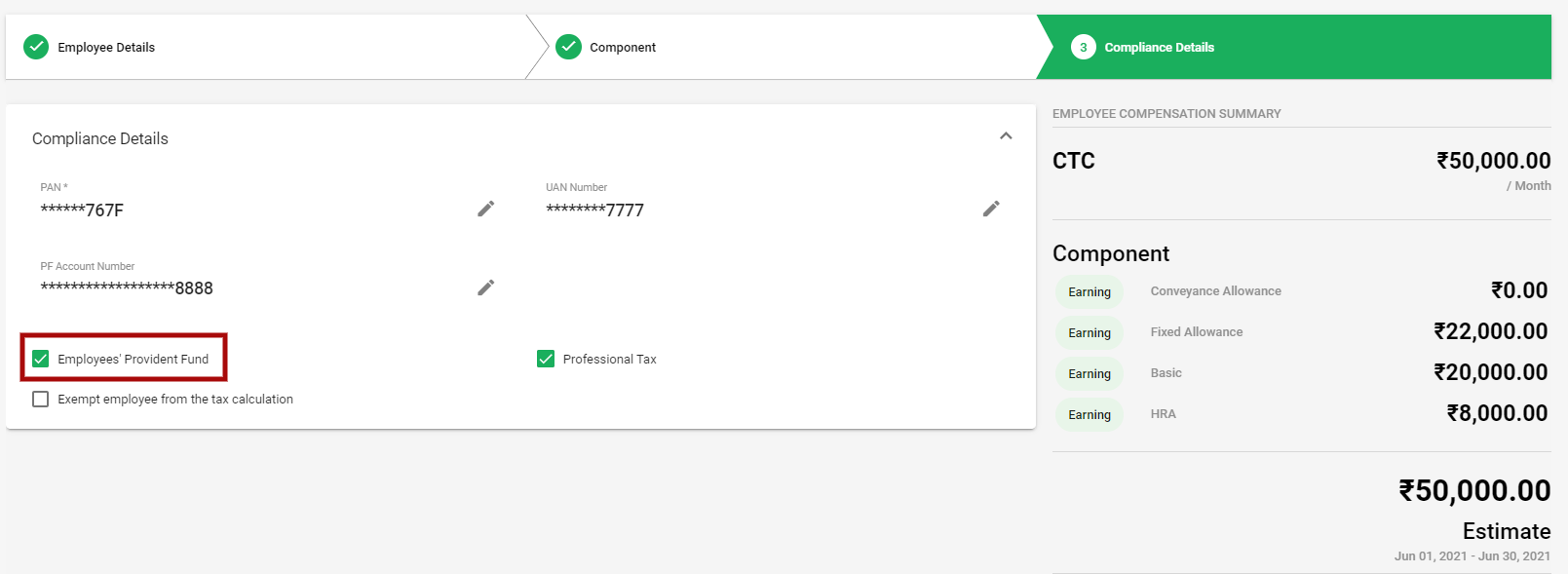

Aug 29 2017Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as the EPF a social security fund established under the EPF Act to provide retirement benefits to employees working in the private sector. Rent paid when House Rent Allowance has not been received from the employer. EPF contribution is computed on a maximum salary limit of Rs 15000 per month.

Aug 23 2022EPF deposits and interest were completely exempt from tax until the year 2020. The income tax department has now exempted e-auctioneers from TDS of 1 on e-commerce platforms and these are subject to a few terms. There are no complicated calculations involved in calculating conveyance allowance limit.

Protection of action taken in good faith. While exemptions are part of your salary like the House Rent Allowance. EPF is the main scheme under the Employees Provident Funds and Miscellaneous Provisions Act 1952.

Interest on education loan. The actual gratuity amount received. Dearness Allowance DA is an allowance paid to employees as a cost of living adjustment allowance paid to the employees to cope with inflation.

Jun 22 2017As an employee working in a corporate set-up there are several things one would like to know about the Employees Provident Fund EPF. Interest on home loan applicable to first-time homeowners Rs50000. The government then decided to exempt vital Covid-19 items such as oxygen equipment vaccinations and other important items exempted from being charged custom duty and cess.

11 Essentials Of Employees Provident Fund Epf 11 News India Tv

Epf Nps Employer S Contribution To Epf Nps Over Rs 7 5 Lakh Proposed To Be Taxed

Epf Deduction May Increase Soon But Not For Everyone Mint

Employee Provident Fund Epf Contributions Rates Benefits

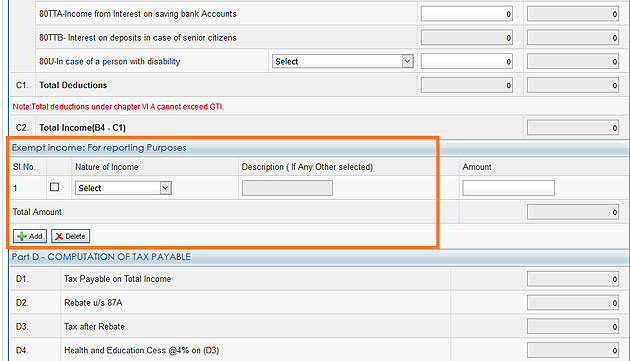

Itr 1 Filing Income Tax Returns How To Report Tax Exempt Incomes In Itr 1

Which Payments Are Subject To Employees Provident Fund Epf Gan And Zul Advocates Solicitors

Wages Or Salary Payment Subject To Epf Contribution

Section 80c Deduction Under Section 80c In India Paisabazaar Com

What You Need To Know About Epf Accounts Businesstoday Issue Date Feb 28 2013

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Employee Provident Fund Epf Eligibility Balance Check Claim Status

Employees Provident Fund Epf As A Tax Saving Tool Comparepolicy

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Employees Provident Fund Eligibility Features Benefits

Pf Provident Fund On Special Allowances As Per Supreme Court Youtube

Comments

Post a Comment